Cancer

Heart Disease

Accidents

Cancer1 in 5 people are diagnosed with cancer during their lifetime

1.9 Million people diagnosed in 2021, with a 68% survival rate in the U.S. (ACS 2021 Report). PCL offers cancer insurance plans that help with treatment and the financial impact after diagnosis. Don't put off joining a plan to help insure your treatment and financial risk. |

Heart AttackHeart attacks are mostly thought of as a health issue related to senior citizens, with the average age of heart attack victims being 65-72 years old. However, the truth is that they can occur within younger age groups as well. One in five people who experience a heart attack are less than 40 years old.

In 2020 in the United States, coronary heart disease (CHD) was the leading cause (41.2%) of deaths, stroke (17.3%) of deaths in the United States. What is your financial risk? Heart attack and Stroke Insurance may help the financial impact to your family. |

AccidentAccording to the CDC, nearly 136 million patients visit emergency rooms in the United States per year, with around 30 percent of those visits relating to injuries.

What is your financial risk? PCL Insurance Brokers may help find the right plan for you and your family. |

Family Health

Dental * Vision

Medicare

Individual, Family and Group Health Insurance PlansPCL agents can help find the right plan for your needs.

|

Dental and Vision PlansMany options here. Let us find a plan for you.

|

Medicare Eligible PlansThe plans and options for Medicare eligible recipients are always changing. Let us help navigate the options available. timing and price are important. Reach out and let us go to work for you without pressure or obligation.

|

Our #1 recommendation, essential life insurance.

In 1904, a young entrepreneur named Amadeo Giannini created the Bank of Italy in a converted San Francisco saloon. His goal was to make financial services available to everyone — not just the wealthy few. And so he did; after the 1906 quake and fire, Giannini set up a makeshift bank on the San Francisco docks, giving residents loans to rebuild, secured with only a handshake. In 1928, Giannini merged with Bank of America, and in 1930 acquired Occidental Life Insurance Company through Transamerica Corporation. The banking and life insurance businesses separated in 1956, with the latter taking the Transamerica name. And in 1972, the now iconic Transamerica pyramid claimed its place in the San Francisco skyline .

PCL Southern shares in the mission of Transamerica as stated: From our very beginning we've been committed to helping you build a solid financial foundation for now and the future. And we’ll continue to do so, providing hope and inspiration today while establishing patterns that build brighter tomorrows. We provide financial knowledge and products that are exceptional and affordable.

In 1904, a young entrepreneur named Amadeo Giannini created the Bank of Italy in a converted San Francisco saloon. His goal was to make financial services available to everyone — not just the wealthy few. And so he did; after the 1906 quake and fire, Giannini set up a makeshift bank on the San Francisco docks, giving residents loans to rebuild, secured with only a handshake. In 1928, Giannini merged with Bank of America, and in 1930 acquired Occidental Life Insurance Company through Transamerica Corporation. The banking and life insurance businesses separated in 1956, with the latter taking the Transamerica name. And in 1972, the now iconic Transamerica pyramid claimed its place in the San Francisco skyline .

PCL Southern shares in the mission of Transamerica as stated: From our very beginning we've been committed to helping you build a solid financial foundation for now and the future. And we’ll continue to do so, providing hope and inspiration today while establishing patterns that build brighter tomorrows. We provide financial knowledge and products that are exceptional and affordable.

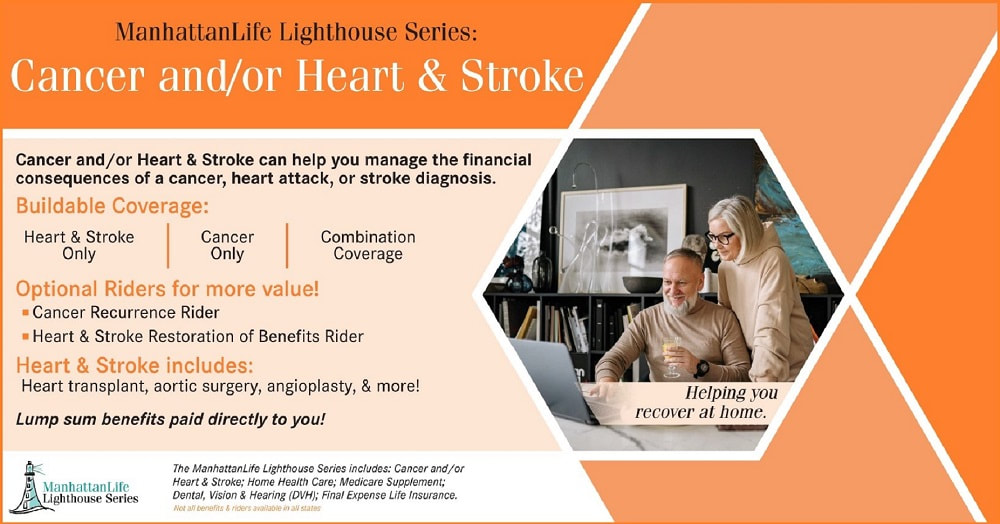

Our #2 recommendation, Consider a First Diagnosis Cancer Plan to provide a cash reserve to help financially during diagnosis and treatment of cancer.

Health care costs need to be part of your essential financial planning.

Cancer has become commonplace and it is rare to not be able to identify someone we know who has not experienced some type of cancer. The American Cancer Society expects 2 Million people will be diagnosed with cancer in 2024.

Cancer has been one of the top two leading causes of death in the United States for over 75 years. According to the National Cancer Institute (NCI), nearly 40% of all Americans will be diagnosed with cancer at some point in their lives.

The survival rate is increasing. Life insurance is not as effective for financial hardships for survivors. A first diagnosis cash cancer plan can help!

In 2022 (Takes a few years for the CDC to release reports) US leading causes of death:

Health care costs need to be part of your essential financial planning.

Cancer has become commonplace and it is rare to not be able to identify someone we know who has not experienced some type of cancer. The American Cancer Society expects 2 Million people will be diagnosed with cancer in 2024.

Cancer has been one of the top two leading causes of death in the United States for over 75 years. According to the National Cancer Institute (NCI), nearly 40% of all Americans will be diagnosed with cancer at some point in their lives.

The survival rate is increasing. Life insurance is not as effective for financial hardships for survivors. A first diagnosis cash cancer plan can help!

In 2022 (Takes a few years for the CDC to release reports) US leading causes of death:

- 1. Heart Disease: 702,880

- 2. Cancer: 608,371

- 3. Accidents (unintentional injuries): 227,039

Our #3 recommendation: Dental and Supplement Insurance